- Southeast Asia is big

Southeast Asia, and the 10 member countries of ASEAN (the Association of Southeast Asian Nations) in particular, represents 9% of the world’s population, with a GDP of almost USD 2.6 trillion. The 10 nations of ASEAN are Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

- Diverse and growing markets and industries

In addition to some of the more traditional manufacturing industries, the ASEAN member states are becoming globally competitive and attractive to foreign investors in a wide range of industries, including:

- the healthcare market for pharmaceutical and medtech companies represents an enormous growth opportunity, with healthcare spending growth expected to exceed growth in BRIC countries in the next few years

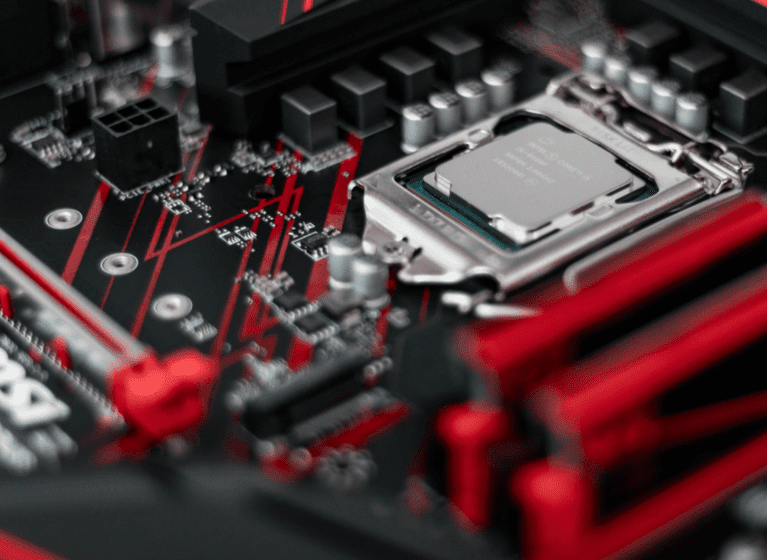

- the electronics sector has seen rapid and sustained growth over the past 5 years, with more competitive offerings by exploiting , for example, the rising labour costs seen in countries like China

- ASEAN member states are playing an increasingly important role in the chemical industry, from speciality chemicals to petrochemicals. And that role is not just in respect of production, but also their research and development capabilities

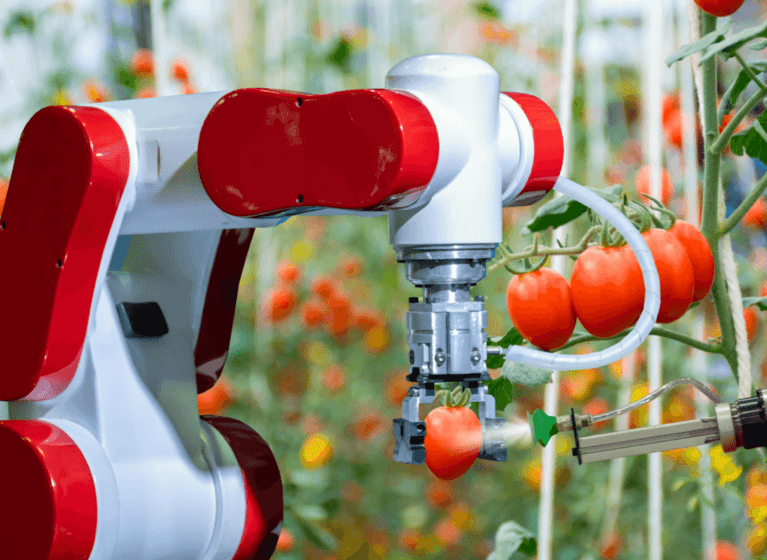

- agriculture has been, and remains, one of the biggest industries. But with the establishment of the ASEAN Economic Community (AEC) in 2015 and the opening up of free trade between the member states , agribusiness is an emerging market that goes beyond employing and feeding citizens of the region

- energy-related challenges and a desire to lower reliance on fossil fuel imports has seen a boom in the energy and cleantech industries in SE Asia. The need for alternative and cheaper fuels, renewable energy, clean energy and pollution reduction combined with lower market-entry barriers for foreign investors are all driving the growth of this industry

- SE Asia has become a leader in the automotive industry. Most major car companies have manufacturing and in many instances engineering design centres in the region, which cover everything from car and part production and export, to research and development facilities for vehicles powered by alternative fuels and autonomous vehicle technology.

This diversity and increased recognition of the value of this region is further reflected by almost 250 companies choosing to have their headquarters in one of the ASEAN member states – a fivefold increase in less than 10 years.

- Robust IP laws

With increasing free trade and movement of goods between ASEAN member states, a key question is the cost benefit analysis of patent filing to ensure broad protection against the distribution of infringing goods. In this regard, filing and prosecuting patent applications in SE Asia can be managed to be quite cost-effective by virtue of most patent offices relying on the examination outcomes of the US, EP, AU and SG.Reliance on ASPEC is another option. The ASEAN Patent Examination Co-operation is a regional patent cooperation programme for sharing patent search and examination results. The primary objective of the programme is to provide faster turnaround and better-quality results of patent search and examination.Moreover, the ASEAN member states are committed to further improving their own and regional IP systems. The objective of the ASEAN IPR Action Plan 2016 to 2025 is to transform the region into an innovative and competitive region through the use of IP, via their 4 strategic goals:- To develop a more robust ASEAN IP system by strengthening IP offices and building IP infrastructures.

- To develop regional IP platforms and infrastructure, via IT upgrades and online processes.

- To expand the ASEAN IP Ecosystem to (among other things) promote building respect for IP and enhancing co-operation on regional IPR enforcement.

- To enhance regional mechanisms to promote asset creation and commercialisation, and promote IPR protection and commercialisation.

- Improving patent enforcement regimes

The AEC Blueprint 2025 recognises that protecting intellectual property rights (IPRs) “is critical for ASEAN member states to move higher up in the technology ladder, in encouraging transfer of technology, and in stimulating innovation and creativity”. The member states acknowledge that despite the improvement in many IP systems in SE Asia, enforcement remains a challenge.

As added motivation, the Office of the United States Trade Representative conducts an annual review of the state of IP protection and enforcement in US trading partners and publishes ‘watch lists’. The IP issues of most concern are counterfeit goods and the inadequate protection and confidentiality of data to obtain regulatory approval for pharmaceutical and agricultural products. But progress in enforcement regimes has seen many SE Asian countries removed from this list. And indeed, only 3 SE Asian countries remain on the 2017 list.In any event issues such as these are not unique to these 3 countries, or indeed to SE Asia. And while enforcement is a consideration for any filing strategy, it should not be a deterrent. The initiatives of the ASEAN IPR Action Plan 2016-2025 are seeking to achieve enhanced co-operation in regional IPR enforcement, and implementation of trade policies will create more competitive domestic markets for foreign companies. - Competition

The percentage of foreign applicants filing in the ASEAN member states is increasing each year. On average, foreign applicants file 6 to 10 fold more applications per year compared to locals. So put simply, if your competitors are filing here then you are at risk of losing your competitive advantage, and have fewer options to protect your goods.